Using Predictive Models on Limited Time Offers

Limited Time Offers are a major marketing lever in the restaurant industry.

Using web-scrapped data, Sense360 performance metrics and basic prediction models (Random Forest Regression & Logistic Regression) we were able to unpack drivers of success. The results were published in the Franchise Times (restaurant trade publication)

Methodology & Project Description

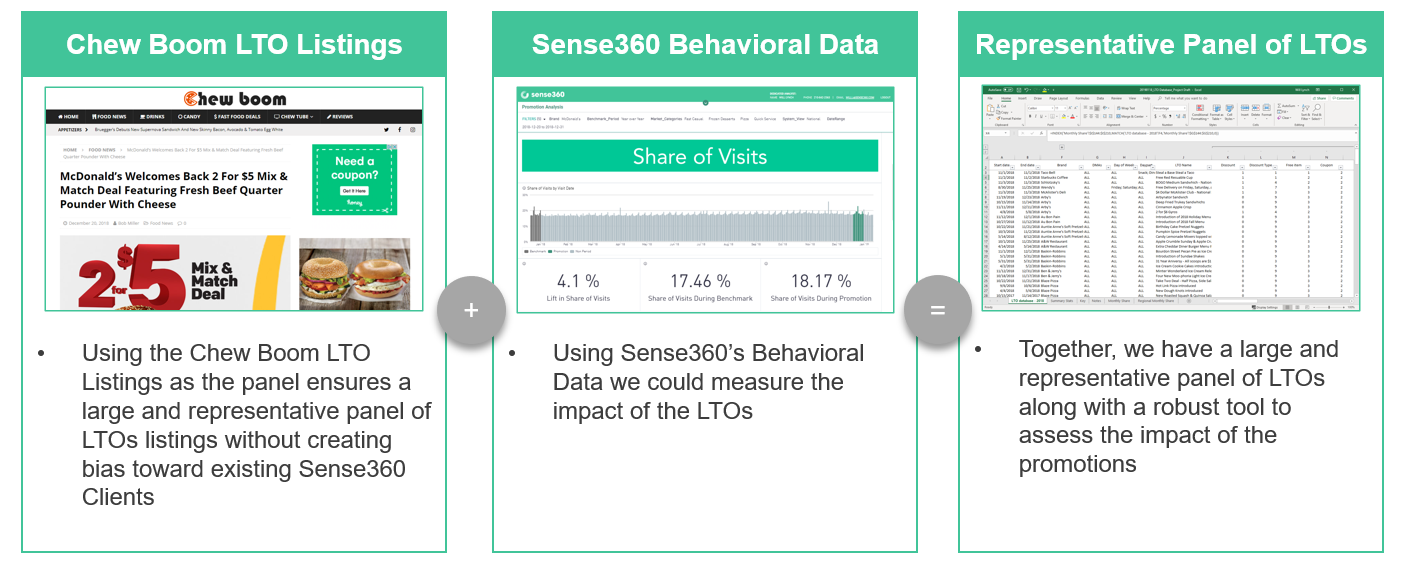

Sense360 is a big data analytics platform with a robust methodology for measuring the impact of individual Limited Time Offers (LTOs) in the restaurant space. However, prior to this project, we had not collected and analyzed a large group of LTOs at once.

You might be able to guess where we are going next but, our goal with this project was to rectify that issue by analyzing performance in aggregate across a large number of LTOs.

We started first by scrapping the web to collect a dataset of LTOs from a single year (2018). In total we captured a little over 200 LTOs from 68 distinct brands, with information on dates, day of week, time of day, location restrictions, method of redemption, and type of offer.

We then ran the information captured through our platform to add performance metrics. We chose to use our Visit Share metric representing how a brand’s share of total market visits changed during the promotion window compared to their performance prior.

Finally, we analyzed the relationship between the promotion variables and the performance of the brand during the promotion using logistic & random forest regression.

Results

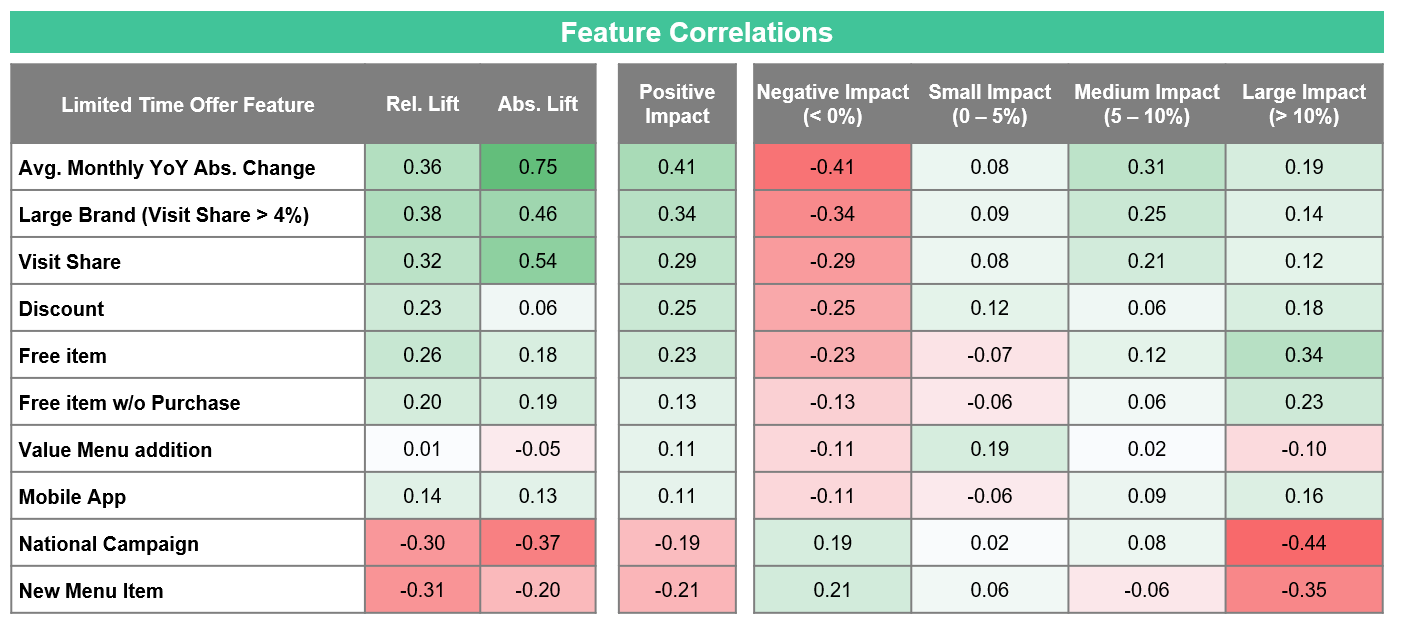

We analyzed the impact in three ways:

Absolute & relative change in market share

Binary positive or negative impact on market share

Bucketing the impact on market share into large, medium, small and negative impact

Our findings were summarized in a Franchise Times article

1) It’s hard to stand out in a crowded market.

According to the research, 85 percent of all LTOs in the sample included new menu items. But the data showed a negative correlation with launching a new menu item and year-over-year visit share lift. That shows, yet again, that this market is rough and if a new item doesn’t reach a new audience, it can actually lead to cannibalization of routine sales.

2) Discounts and free items work, kind of.

Discounted and free items correlated with the strongest visit share lift. Of course, incremental lift in traffic at the expense of margins is something QSR operators need to be wary of. These tactics may drive traffic, but low-margin visits can effectively cancel out the benefits of that extra traffic.

3) Momentum matters.

Hot concepts tend to stay hot with continued innovation. The research showed visit share growth was the highest correlated factor to an individual LTOs performance. Large brands especially fared well with a routine LTO cadence, benefiting from national advertising and rosy perception of recent LTOs.

Predicting the future?

Finally, we wanted to understand if we could use this information in a way that could give our clients an edge, could we help them predict the future?

With a small dataset and a large number of important variables that were not included (marketing spend, consumer sentiment on the item, etc.) we knew it was a long shot. However, using the data we had with a test-train logistic regression, we found that there was some predictive power in our model.